Why Mortgageport?

Nimble, tailored, and trusted

As a lender and mortgage manager we custom-design home loans to fit you, and not the other way round. We pride ourselves in offering a better deal than the banks or brokers while delivering service that hasn’t lost its personal touch.

-

Fully accredited

Mortgageport is a long-standing member of the Mortgage & Finance Association of Australia (MFAA).

-

Here for the long term

We’ve been helping customers secure finance since 1998.

-

Flexible

We customise loans with the features you want and competitive rates to suit your needs.

-

Personal service

Our Lending Managers are dedicated to their clients’ success and serve as the single point of contact.

-

In-house credit team

We approve your loan in-house, so you don’t have to wait in line to get an answer.

-

Trusted and recommended

More than 150+ independent accounting firms refer their clients to us because of our expertise and service.

Home loan calculator

Calculate your borrowing power at-a-glance

If you’re not sure, let’s talk.

Rates & key features

Enjoy the best rates on a fixed or variable rate home loan that we customise to your needs.

Variable rate home loan

Enjoy the flexibility and benefits a variable rate home loan offers.

With no penalties for early repayments and the ability to redraw extra payments, a variable rate home loan offers maximum flexibility.

Variable rates from

p.a.

Interest rate *

p.a.

Comparision rate *

Fixed rate home loans

Lock in certainty with repayments that will stay the same over a fixed period.

Fixed rate home loans offer maximum certainty, giving you peace of mind for budgeting and no surprises over the fixed loan term.

Fixed rates from

p.a.

Interest rate *

p.a.

Comparision rate *

Features and benefits

We provide more value to our customers because we appreciate you.

More flexibility means a better home loan for your specific needs and situation.

Rates & Fees

- Great rates on fixed and variable loans

- No ongoing fees

- No ongoing account keeping fees

Features & Inclusions

- An investment loan structured to meet your specific situation

- The flexibility of principal + interest or interest only up to five years, and up to four separate loan splits

- Stay in control of finances with a simplified monthly statement that tracks your offset balance, loan balance and all transactions

- Minimise the size of your deposit with a Loan-to-Value Ratio (LVR) giving you borrowing capacity up to 95%

Save More With Offset Account- Minimise your interest payments with a 100% Offset Account

- Immediate access to money in your Offset Account when you need it through ATMs, online banking or in person

- No need to commit to regular deposits to your Offset Account over and above your loan repayments

Loan Process

Our simple process that delivers the best possible home loan for you

Got questions ? We have the answers

Question not answered?

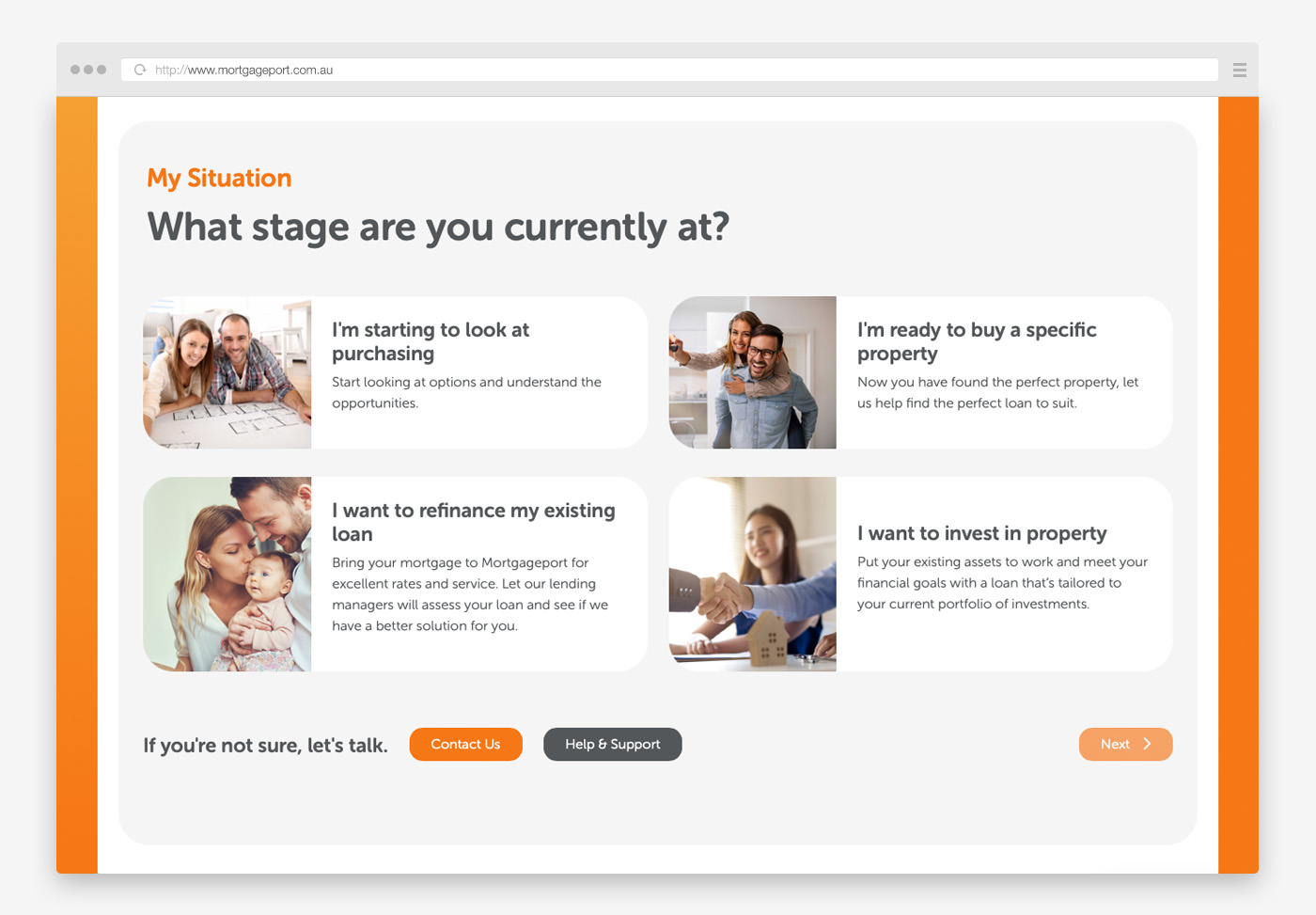

The next step is yours

However you feel comfortable, start your journey in your own way.

Got question, ask us.

Pre-qualify today

By answering a few short questions, we can assess your borrowing power and come back to you to finalise your application.

Request a call back

Let us contact you and talk you through the process, regardless of your needs.

Apply now

Start your home loan application by providing us with your details, and we can take it from there.

Our specialised home loan consultants can make it happen.

Our team

John Berghella

John Berghella is Sales Manager for MyChoice, a joint venture between Mortgageport and McDonald Jones Homes.

Phil Mikhail

Phil Mikhail is National Sales Director - Direct, responsible for scaling up the Sales and Distribution team.

Alwyn John

Alwyn John is responsible for managing the progress of residential mortgage loans.

Renata Hermida

Renata Hermida approaches every client interaction with a commitment that goes beyond transactions.

Bill Ryan

As a Senior Lending Manager at Mortgageport, Bill Ryan helps his clients in building a secure financial future.

Michael McKelvie

Michael McKelvie is the Senior Manager, Origination and is responsible for writing loans for our customers.

Meet more of us

Our TeamReady? We are too!

Let’s get you where you want to go.

We provide many ways you can get in touch with us. Whether call, in person or email, we can work into your busy day as you need.

Book an appointment

Find a time on your calendar and let us know. We’ll call you back and discuss your needs.

Email your enquiry

Take the time to outline your needs and we’ll take the time to make it happen.